It took me longer to get this final video shot than I expected.

After shooting the first 3 video’s and outlining the Characteristics of wealth all week, I wanted to really think about what

was the last characteristic of wealth that will truly close up this series.

Most people would think the 4th and final would be Financial Wealth and accumulation of things and possessions. But what I have learned in the last 9 years while building out financial empire, is that wealth is not just about the money of the things that you can buy or a quire. We have had our richest years from the experiences , not the money we have in our bank account.

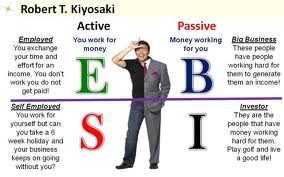

Robert Kiyosaki discusses the 4 quadrants of wealth or “CASH FLOW QUADRANTS”of moving from Employee to Self empolyed to Big business to investor.

Robert Kiyosaki discusses the 4 quadrants of wealth or “CASH FLOW QUADRANTS”of moving from Employee to Self empolyed to Big business to investor.

The CASHFLOW Quadrant is divided into four types of people.

E is for Employee

S is for Self-Employed or Specialist

B is for Big Business

I is for Investor

On the left side of the quadrant are Es and Ss. They pay the most in taxes and trade their time for money.

On the right side of the quadrant are Bs and Is. They pay the least in taxes and create or invest in assets that produce cash flow for them even when they’re sleeping.

It’s my belief that the dividing line between those who are struggling in today’s economy and those who are prospering is the line between the two sides of the CASHFLOW Quadrant.

In this downturn, it is employees and self-employed people who are struggling as jobs are scarce and the cost of living is rising. Because they have only their time to trade, and that is not in high demand, they are at a disadvantage. Additionally, the products they need in order to live like food, gas, and more are becoming more expensive.

On the other hand, those who own big businesses and who invest are becoming richer and richer. Corporations are sitting on piles of cash and investors are cherry picking the best assets at rock bottom pricing.

Many in the E and S quadrants are holding on for the economy to pick up, and if it does, they will do well as the demand for people’s time—employment—goes up. That being said, the will still pay the highest in taxes and still be under the mercy of their employers and the economy. Until then, they will struggle because they have nothing else to offer and no other way to make money. Employees and self-employed always do badly in a down economy.

Those in the B and I quadrants, however, are doing well and taking advantage of the downturn to get richer. And if the economy picks up, they’ll also do well as the assets they’re investing now will pay dividends at the lowest tax rates—sometimes zero—in the up market, all while retaining control over their money and investments. Unlike, Es and Ss, Big business and investors can do well in both down and up markets.

If you’re struggling in this downturn, I encourage you to begin changing your mindset. Start making plans and taking action to move from the left side of the CASHFLOW Quadrant to the right side.

Invest in your financial education, begin a side business, or start investing for cash flow.

Start small and move onto bigger things, but have a goal to become a B or I. It won’t happen overnight, and it will be hard work. But if you’re diligent, plan well, and execute your plan, you’ll be much better off in the future whether the markets are up or down.

Today Be UNSTOPPABLE!

Rhonda Swan